- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Manage your tax settings on Square: FAQs

Disclaimer: Tax compliance is your responsibility. We do not guarantee the applicability or accuracy of our tax tools. If you have any questions about your tax obligations, you should consult a professional tax advisor.

With Square, you can easily create and manage your tax settings whenever you need from your Square Point of Sale app or from your online Dashboard.

In this post, we’ll be running through some common questions around managing your tax settings on Square. If you have any other question, click Reply 👇. We’re happy to help!

Let’s get started:

How can I create item taxes?

You can create and apply multiple item taxes either from your Square Point of Sale app or from your online Dashboard by following the steps outlined here.

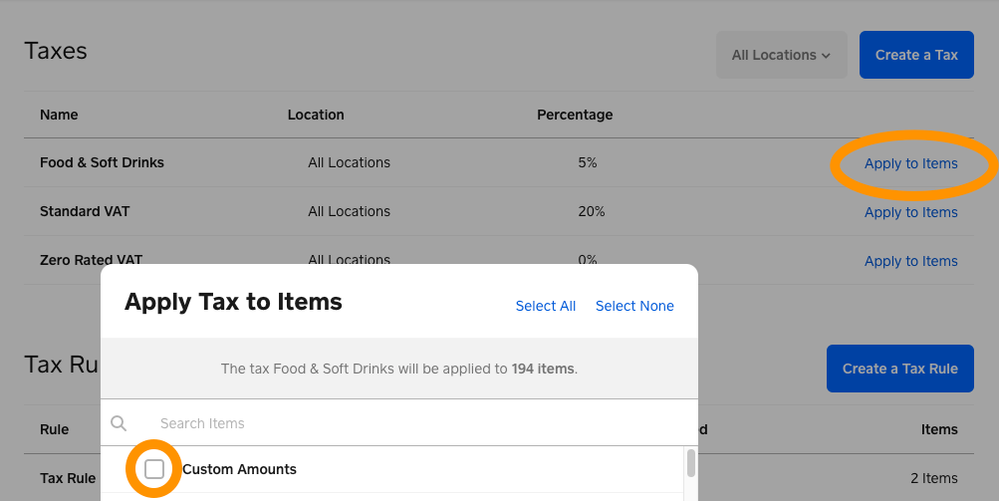

🧮 Note 🧮: Taxes will automatically apply to sales where a customer amount is entered. To disable taxes for custom amounts, you’ll need to click Apply to items next to your tax rates and untick Custom Amounts.

Can I edit my taxes while making a sale on the app?

Yes, you can edit your taxes at the time of sale. To do so, tap Current Sale at the top of the screen or Review Sale.

Tap into Tax and the red minus icon to remove a tax rate from applicable items within the sale.

Do my tax settings sync to my Online store?

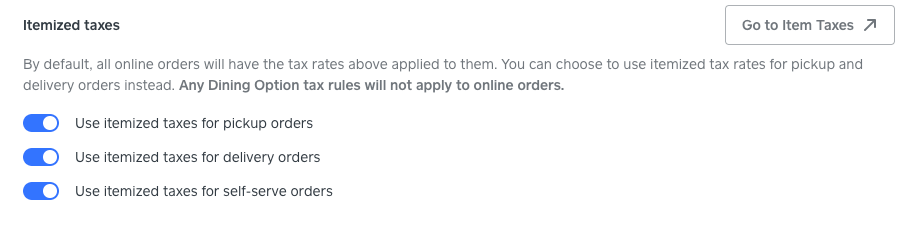

By default, you’ll need to set up your taxes again from your Online Store dashboard. However, you can choose to use the tax rates you’ve created on your Square Point of Sale app for pickup, delivery and self-serve orders. Learn how to create taxes for Square Online in our Support Centre.

To do so, head to Settings > Sales Taxes on your Online Store dashboard and toggle the button to blue next to Use itemised taxes for pickup orders/delivery orders/self-serve orders.

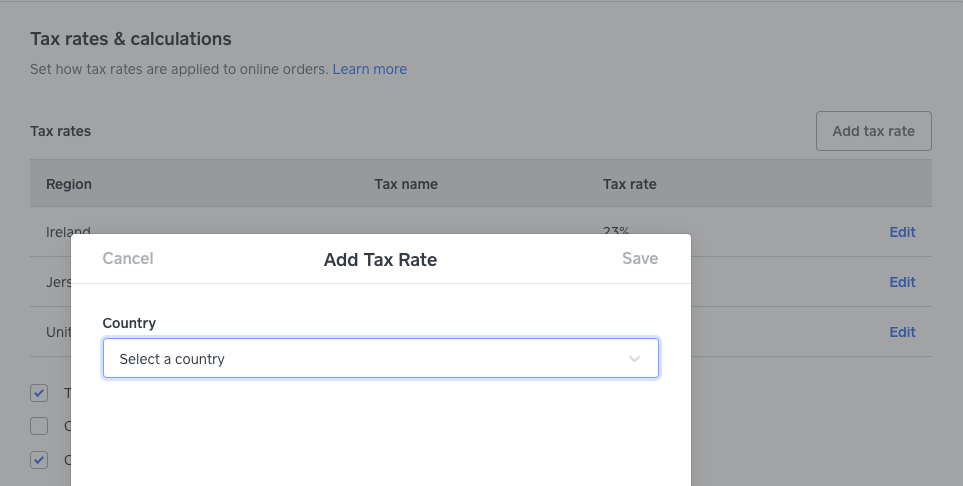

I sell and ship items internationally - how can I set up tax based on my customers’ locations?

If you sell and ship items internationally online, you can create tax rates based on your customers’ location from Settings > Sales Taxes on your Online Store dashboard. Simply click Add tax rate, select the country from the dropdown and enter the applicable tax rate.

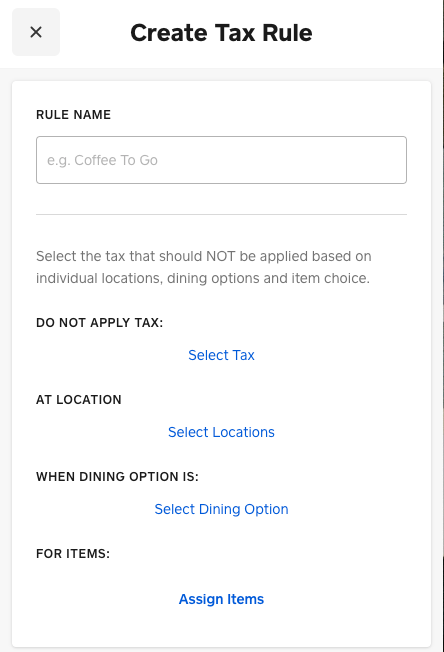

I have different taxes setup for eat in and takeaway - is there a way to automate this?

You can create tax rules so taxes are automatically adjusted based on whether your customer is ordering or eat in or takeaway.

🧮 Note 🧮: Before creating tax rules, you’ll need to make sure the following are setup

Once that’s done, you can go ahead and create your tax rules from your Square Dashboard. Learn how to create tax rules here.

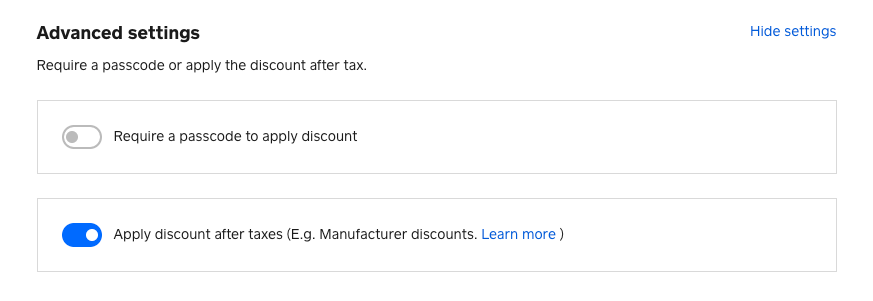

Are discounts applied pre or post-tax?

You can specify whether a discount applies pre or post tax when creating a discount from your Dashboard. To do so, simply click Show advanced settings and toggle the Apply discount after taxes to blue.

Learn more about creating and managing discounts in our Support Centre.

How can I track my taxable sales?

You can use the Tax report to track your taxable and non-taxable sales.

🧮 Note 🧮: ‘Taxable sales’ may not add up to the ‘total’ tax collected because some sales and items may have multiple tax rates applied.

Community Engagement Program Manager, Square

Have a burning question to ask in our Question of the Week? Share it with us!

- Labels:

-

Square Point of Sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content