- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

The title of this thread has been edited from the original: FICA Taxes

Does Square Payroll automatically deduct FICA taxes or is it something I need to do manually?

- Labels:

-

Payroll

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

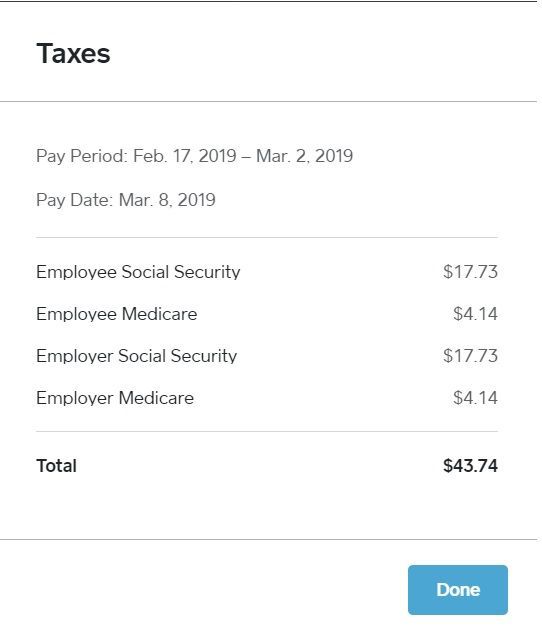

@VanKalkerFarms is correct. There are no taxes that you need to deal with. Below is a screenshot of a recent payroll history.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Square payroll takes care of all the payroll related deductions. I don't use it so let me tag in someone that does so they can answer your questions better. @ACAcatering

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

@VanKalkerFarms is correct. There are no taxes that you need to deal with. Below is a screenshot of a recent payroll history.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I have employees who are exempt from FICA taxes. Is there a way to handle that? @ACAcatering

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

👋 Helen here @yliu1979. Right now Square Payroll isn't able to support FICA exempt employees. I'll share your feedback with the Payroll team - hopefully we'll be able to support these employees in future.

Seller Community Manager

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Has this issue been resolved? I have 2 dependent children that work for me and thus they are exempt from having to pay any FICA. I want to enroll them in payroll on Square but I can't if it's not possible to claim this legal exemption. Thanks for any info you can provide.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

have you found a resolution to this? I also have a dependent child that I need to figure out how to pay being exempt from both FICA and FUTA. I have other employees on square and would like to add him, but cannot figure out how to get around those taxes. How else can I pay him "legally"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey @Micheler.

At this time Square Payroll is not able to exempt employees from FICA and FUTA. We are working hard and hoping to make this a possibility soon, but until then this is considered a Feature Request. Thank you for resurfacing this.

Also wanted to Welcome you to the Seller Community ✨

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

JJ, I too would like to pay my children without FICA and FUTA. Any idea when this feature might be available?

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello @Mwilde1!

Welcome to the Seller Community, we're always happy to see new faces.

Stepping in for JJ here.

When it comes to this feature request, we don't have a timeline for it yet.

We will be updating this thread when we have more information to share.

Thank you!

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Any updates on this? I am in the same situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello @JFT

Yes, Square will withhold FICA, both the employee and the employer portions. You can learn more about this in our Square Payroll Tax Filings and Payments guide.

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Has this issue been resolved yet? I need to be able to pay my children without FICA and FUTA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey @gevans0

At this time, Square Payroll cannot exempt employees from specific taxes. This is considered a feature request. We’d love it if you'd submit this request on our Ideate page for Square Payroll. Our team monitors these boards, and we triage them to measure needs. You can search the boards to see if this has been requested before and add your use case if so!

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

This request is going g on 4 years old. Is anyone at Square able to hel with this issue?

I have a new tax exempt employee, and their taxes were taken out, even though they marked "exempt" on their W-4.

What does marking exempt mean for Square payroll, as the option does not seem to be exempting anything.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Thank you @VanKalkerFarms @ACAcatering!

@JonS82 I also checked in with our Payroll team who added that Payroll will debit for FICA based on the information on the Employee's W-4. Hope this helps!

Seller Community Manager

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report