- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

On November 10th, 2021 we hosted a Q&A with our Commerce Platform team which focused on sales tax settings.

The Commerce Platform team manages the sales tax product experience: everything from configuring tax settings in the online Square Dashboard to applying taxes to a sale, reporting, and filing.

One of the main goals of this event from our side was to ensure you're getting the most out of your tax settings and identify where Square can improve. We can't share out specific details on our product roadmaps, though we will certainly make sure all of the replies that came through on this post are considered as we iterate. Thank you to everyone who participated!

- Labels:

-

Square Products

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello Everyone,

Thanks again for taking the time to share your questions and feedback!

We hope your questions are answered—the experiences you've shared will help us as we continue to make improvements on Sales Tax settings. With that, I wanted to highlight a few themes from this discussion:

A few of the feature requests that you mentioned are coming soon and available for Beta

- Category based Tax configuration

- Exemptions based on the Item price

- Exemptions based on the total price of a few items in the cart

To request for Beta participation, please send a Private Message to @divyar if you would like to talk further.

General information about available features

- Dashboard Sales Tax has a new location and experience. To manage Sales Tax, go to Accounts and Settings > Business > Sales Tax on Dashboard. Read more in our Support Center: Create and Manage Your Sales Tax Settings.

- We offer the ability to Disable a Tax temporarily. This can be used for tax holidays, when you open a booth at a different tax location and want the POS tax rate to not apply on the cart.

- Sellers who include the tax in their item price can turn on the tax inclusive toggle in the Sales Tax page for accurate tax calculations.

- With Square savings you can create a dedicated folder to hold your collected taxes.

Other top asks we heard from you which we are working on solving for

- Square Online Taxes do not sync with POS taxes

- Customer Based Tax Exemptions

We appreciate you taking the time to share and we'll continue to iterate Square’s products based on your business needs. To stay up-to-date on new feature launches, keep watch on the Product Updates board.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

It would be nice to have the option to delete or inactivate a sales tax rate. We occasionally do events outside our normal location and have to add the sales tax for that location, but would like to be able to inactivate it so it doesn't keep getting added to new items that we add to inventory. We have to edit every single item now or it charges all of the rates.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi @CactusQuilter,

You can disable a Tax from Actions > Disable Tax on the top right corner of Edit Tax modal. To re-enable, you will have to come back to the same Actions menu to enable Tax. When a Tax is disabled, it will not apply to any of your transactions. Hope this is helpful.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Great questions, thanks @Tom. My retail store collects state sales tax, so I use Square to assign the tax at the item level; certain items in my state are taxed while other items are not. So when I add an item into my inventory, I can check the box on/off to apply that state sales tax I have setup within my dashboard.

Everything works great with this one exception...some days my tax collected may be a cent off, either too much or not enough. I think this must be a rounding issue. Here's where I see the difference:

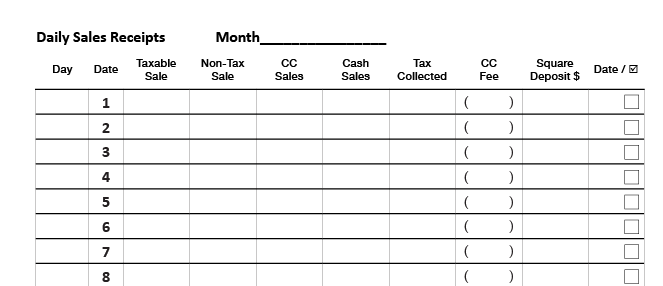

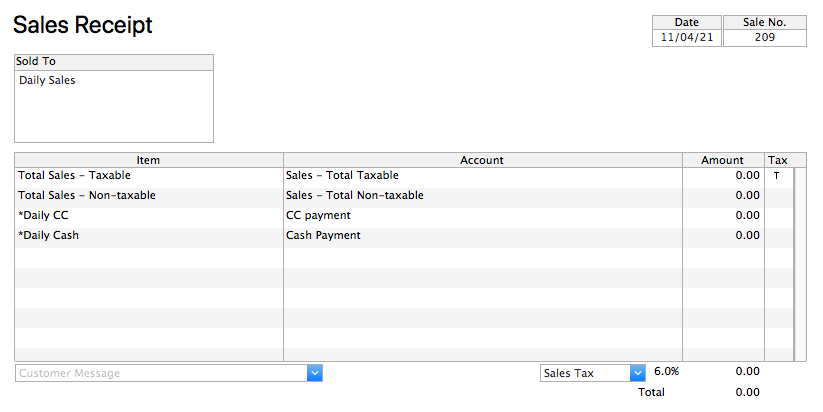

I use Quickbooks Desktop and pretty much manually keep track of daily sales and tax receipts. I use the daily report out of Square and write into a ledger I keep >>>

which in turn I use to input data into a daily sales receipt within Quickbooks. It's there I'll see the total at the bottom either be a .01 plus or minus (where this should end up being zeroed out).

It's not a big issue, I'll add an "adjustment" transaction into the daily sales here so it ends up correct.

Homestyle Charlie

Handmade Heirloom Ornaments & Charms

Check our links for retail Etsy orders and Wholesale Ordering Info

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

The one thing I absolutely hate is that the sales tax settings in Square Online don't seem to sync with Square. Here's what I mean - I created 10 new items in Square Online and sales tax is setup to automatically be turned on for all of those items (for sales in my state). Now, I go to an event and have my Square Reader with me. When I try to sell one of those 10 items, no sales tax is applied! I have to remember to go into the Square app, go into Settings, go into Edit Tax, then Applicable Items, and click "Tax All". And I have to remember to do that EVERY TIME I ADD NEW ITEMS. I run a bookstore so we often add new items on a daily basis. If Sales Tax is being applied on Square Online, it should automatically be setup the same way on the Square app.

The Violet Fox Bookshop

https://thevioletfoxbookshop.square.site

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

This is my exact situation, too. POS taxes sync with online when an item is added through the POS app, but not the other way around. I forget a lot, and usually have to edit the item on site while the customer is waiting. I enter 100% of my items in Square Online because the setup is much easier there. I sell the same items onsite, so I would like the Online items taxes to sync with the POS.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Just curious since I sell online and from POS and didn’t know this was an issue. What do you mean about taxes not syncing? Are you talking about sales taxes or another type of tax? Wondering if I’m missing something about how my system is set up 🤪

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Very good summary of your concern and a great lesson on how to enable the sales tax feature. I am just starting to set up my items and was wondering what steps should I take to include sales tax in my purchases. Thank you for sharing!

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Thanks for all the feedback here! I agree that this is an annoying additional step to have to keep track of. We are working on a solution that will address this issue.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Awesome! So glad to hear that this in the works. Thanks!

The Violet Fox Bookshop

https://thevioletfoxbookshop.square.site

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi @Thevioletfox ,

Thank you for your feedback. We are unable to share the timelines but we are actively working on integrating the sales tax experience of Square Online and POS.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Very cool! I'm looking forward to it! 😊

The Violet Fox Bookshop

https://thevioletfoxbookshop.square.site

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Any update on this?? I'm gearing up for my first in person event this year where I will be using the POS app. I use my Square Online store only most of the year. All items I've created in Square Online since my last in person event (almost a year ago) are coming into the POS app with the "no sales tax" setting . Everything in my online store charges sales tax. Why does this setting not sync to the POS app?

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi Nicole, I just enabled this feature in your account. You should see a new setting on the tax page to have a tax apply to 'All taxable items' if you click that toggle then your tax will apply to all items regardless if they were created on Square Online or on Square.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Thanks!!

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Would love the ability to change the tax rate. We have a set 6.5% rate for retail sales. But our booth rent commercial rent rate is 6.2%. Would like to be able to change on invoices. Thank you.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi @LuckyCat ,

Want to clarify so that I understand your use case correctly. You have a booth that is not an actual point of sale location. The tax rate applicable for the booth is 6.2% while your POS location tax rate is 6.5%. In this case, you could try creating two tax rates. When you are at the booth, disable the tax rate that applies to POS location and vice versa. Hope this helps.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

My building materials business sells Retail w/ sales tax and Resale to licensed installers/ trades professionals with a State issued Resellers Permit.

I would like a place to select Resale rather then just turning the tax off for the transaction, as we are required to keep records of Resale sales. Would be even better if we could have Reseller company profiles with the permit# on file so when they purchase the tax is automatically set to Resale.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I wanted to second what skiibum wrote about having a resale and/or exempt option in the company profiles. My company does a fair amount of work where the job is considered a capital improvement so sales tax is not charged. It becomes a small annoyance to have to remember to turn sales tax off before sending the final invoice to the customer.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Thanks for the feedback. It sounds like there is interest in something similar to Customer Based Discounts for taxes.

@skiibum, is there any special documentation you have to provide as part of tax filing for these types of sales?