- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello Seller Community,

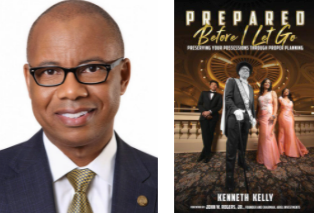

On Tuesday, March 22, we were honored to have guest author, Chairman, and CEO of First Independence Bank, Kenneth Kelly, join our forums. His work focuses on economic equality and he has extensive experience with community banking, minority depository institutions, and working minority business owners.

Kenneth recently authored a book that covers legacy planning – Prepared Before I Go: Preserving Your Possessions Through Proper Planning – which provides his views on how to create a strategy for after we're gone. His book addresses how to keep your hard-earned savings and belongings in the family, and intentionally pass on values and beliefs that are the most important part of your personal legacy.

We know many businesses represented in the Seller Community are family-owned, and wanted to create the space for you to ask our guest author questions about planning ahead, particularly in these areas:

- Will & Trust

- Healthcare Directives

- Power of Attorney

We're grateful to all the sellers who shared their questions and experiences. Take a look at the comments below for a recap of Kenneth's replies and and more information.

Please note that Kenneth Kelly is not an employee or consultant of Square. The information he provides solely reflects his views and is not endorsed by Square. This Q&A is limited in scope and is only intended as a high-level overview of the topics discussed. Block, Inc. (including its affiliates, subsidiaries, employees, officers, directors, attorneys, and tax advisors) undertakes no obligation to fact check or update the information Kenneth provides for future changes in the law. Nothing in this Q&A is or should be used as tax or legal advice. In particular, this Q&A cannot be relied upon for the purposes of avoiding taxes, penalties, or other obligations under applicable law. For guidance or advice specific to your business, you should consult with a qualified tax and/or legal professional.

- Labels:

-

Business

I agree with you. This is a very deep subject that no one person can master independently. My approach to writing the book and developing the technical platform is to “democratize” this program in such a manner that we lower the cost and to educate the community on this subject. Of course I would recommend my book (www.beforeiletgo.com) as a relatable source of stories that each of us can learn. The technology platform allows you to organize our affairs in all 50 states to carry out your wishes or to organize your affairs to share with your attorney or other counselors to help you be prepared.

Thank you!

- « Previous

- Next »