- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello Seller Community,

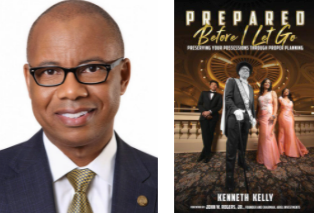

On Tuesday, March 22, we were honored to have guest author, Chairman, and CEO of First Independence Bank, Kenneth Kelly, join our forums. His work focuses on economic equality and he has extensive experience with community banking, minority depository institutions, and working minority business owners.

Kenneth recently authored a book that covers legacy planning – Prepared Before I Go: Preserving Your Possessions Through Proper Planning – which provides his views on how to create a strategy for after we're gone. His book addresses how to keep your hard-earned savings and belongings in the family, and intentionally pass on values and beliefs that are the most important part of your personal legacy.

We know many businesses represented in the Seller Community are family-owned, and wanted to create the space for you to ask our guest author questions about planning ahead, particularly in these areas:

- Will & Trust

- Healthcare Directives

- Power of Attorney

We're grateful to all the sellers who shared their questions and experiences. Take a look at the comments below for a recap of Kenneth's replies and and more information.

Please note that Kenneth Kelly is not an employee or consultant of Square. The information he provides solely reflects his views and is not endorsed by Square. This Q&A is limited in scope and is only intended as a high-level overview of the topics discussed. Block, Inc. (including its affiliates, subsidiaries, employees, officers, directors, attorneys, and tax advisors) undertakes no obligation to fact check or update the information Kenneth provides for future changes in the law. Nothing in this Q&A is or should be used as tax or legal advice. In particular, this Q&A cannot be relied upon for the purposes of avoiding taxes, penalties, or other obligations under applicable law. For guidance or advice specific to your business, you should consult with a qualified tax and/or legal professional.

- Labels:

-

Business

I agree with you. This is a very deep subject that no one person can master independently. My approach to writing the book and developing the technical platform is to “democratize” this program in such a manner that we lower the cost and to educate the community on this subject. Of course I would recommend my book (www.beforeiletgo.com) as a relatable source of stories that each of us can learn. The technology platform allows you to organize our affairs in all 50 states to carry out your wishes or to organize your affairs to share with your attorney or other counselors to help you be prepared.

From my perspective, you have already started the process of estate planning by completing your wills. The estate planning process by definition seems to be overwhelming to many Americans. It is my belief that we should focus on Legacy Planning, which is endearing our actions to ensure that our loved ones or charities that we care about are taken into account upon our departure from earth. For definition purposes: Estate planning is the process of anticipating and arranging, during a person's life, for the management and disposal of that person's estate during the person's life, in the event the person becomes incapacitated and after death. The planning includes the bequest of assets to heirs and may include minimizing gift, estate, generation skipping transfer, and taxes. Estate planning includes planning for incapacity as well as a process of reducing or eliminating uncertainties over the administration of the probate process and maximizing the value of the estate by reducing taxes and other expenses. The ultimate goal of estate planning can only be determined by the specific goals of the estate owner and may be as simple or complex as the owner's wishes and needs directs. Guardians are often designated for minor children and beneficiaries in one’s loss of their capacity. If you and your husband follow through on what’s is listed above, you will have completed an estate plan whether simple or complex.

I am married, no kids, own one business. I have no experience with estate planning, and am wondering what I should do now to make sure my husband gets ownership of the business assets if something happens to me. Also, with no children, I would want to leave my assets to my brother should something happen to me and my husband. Where should I start?

You should develop a Will that allows for you to accomplish your wishes. As noted, you can list all of the types of requests you mentioned above in the platform that I creates. Www.MyLegacyItems.com This process will allow you to organize your affairs electronically for only $49.95/year. It will make your intentions very clear of how you want your possessions distributed. It is obvious that you are on the right track by my book will provide more insight into what other did well and not so well in handling their affairs. Www.BeforeILetGo.com

Let’s change the narrative one family at a time! Best Wishes!

I would like to learn about living trust? When is a good time to set it up? What I mean by that is, is it based on a $amount that the assets are worth or is it age/ health based because the end may be coming sooner rather than later?

How do I preserve my real estate investments without having my children acquire a large estate tax when we pass?

Can you run a business under a living trust? What are the pros and cons to that.

I will start with the latter question. A living trust can own the shares of a company. I do know if you should run the business within the trust, but it could certainly own the shares. A living trust is a great way to preserve the real estate investments for your children. Because I am not a tax advisor, I cannot advise you on the implication of this. There are not minimum amounts need to create a living trust. Oftentimes individuals assume you need to be wealthy to implement them. My philosophy is to typically weigh the cost of doing a trust vs not doing one. If the asset base is relatively simple, it may be the best options for decision making declarations; otherwise, the beneficiary may have unfeathered decisions regarding the asset.

I have estate planning along with a trust already. What Benefit would this give me that I don’t already have ?

It sounds like you have your affairs already in order. I have no further recommendations except to say ensure that all of your information is updates - accounts, family members, status of family (no changes in marriage, children, etc.).

Hi there,

This is a great topic and I'm sure it's never too early to start planning. I would like to know more about the differences between a Will and a Trust. And how to dissolve them should something happen down the road.

Thanks,

Chris

A Will is a declaration that should be filed with the probate court system. A trust allows for more private handling of affairs. There are two major types - revocable and irrevocable. The irrevocable can provide some tax advantages but because of the permanency of the decision, it is very difficult to unwind (dissolve).

My husband and I own a business and our children are not interested in continuing if/when we are gone, hopefully that will change. What should we have in place to dissolve the business when the time comes.

You may consider selling the business to someone who is knowledgeable about the business who can continue your legacy in the sector. Regardless, you should have a plan in place to deal with the business (that your kids may not be interested) that could flounder because of lack of skill and/or knowledge base.

The key suggestion is that focus on the reality of what can allow your transition to align with the company values of My Legacy Items of: Peace, Love, and Legacy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

I have a younger brother with special needs. How do i ensure that if something happens to me, he can be taken care of with money set aside for him through a trust?

I do not have experience with the requirements for individuals with Special Needs; however, I do know that there are books written about the planning horizon and care needs to anticipate to take care of an individual. Upon gaining this knowledge, the tools will very likely be the same to ensure your brothers physical and financial well being. If I can be of further assistance, please feel free to reach out to ken@beforeiletgo.com

How do I best balance business growth through capital reinvestment, vs contributing towards my retirement and estate planning measures?

This is a age old dilemma. The trade off is always if I invest more in my company that i would have a larger nest later that vice versa. However, should finance principles suggest that you should begin investing nearly 18% in your retirement as soon as possible because it will allow you to continue your lifestyle after retirement. While this should like a large amount, the date proves that it works. So without knowing your business and the returns that it provides, I cannot provide a legitimate recommendation to you.

I am glad to be here Andrew!

In an attempt to be proactive, how often should I meet with my insurance agent, (to review all policies in place) investment broker (to review what is happening with my money) and attorney (to review wills, trusts, and etc?)

Thanks for being here. I've also added your book to my purchase list from Amazon!

I appreciate you support. By the way, if you order your book from www.beforeiletgo.com I will be able to send you a signed copy.

To your question, there is not specific timetable on the frequency of the meeting. They should be a function of what is going on in your life. For instance, if you have having kids across every year, the document will need to be update soon.

A reasonable rule of thumb would be annually on insurance agent, quarterly on the investments, and the attorney issues yearly or every two years depending on the scope of your life events (childbearing, vs midlife vs, retirement).