- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello Seller Community,

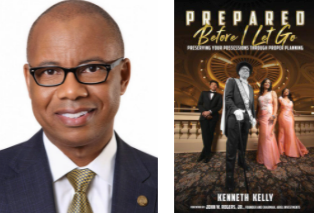

On Tuesday, March 22, we were honored to have guest author, Chairman, and CEO of First Independence Bank, Kenneth Kelly, join our forums. His work focuses on economic equality and he has extensive experience with community banking, minority depository institutions, and working minority business owners.

Kenneth recently authored a book that covers legacy planning – Prepared Before I Go: Preserving Your Possessions Through Proper Planning – which provides his views on how to create a strategy for after we're gone. His book addresses how to keep your hard-earned savings and belongings in the family, and intentionally pass on values and beliefs that are the most important part of your personal legacy.

We know many businesses represented in the Seller Community are family-owned, and wanted to create the space for you to ask our guest author questions about planning ahead, particularly in these areas:

- Will & Trust

- Healthcare Directives

- Power of Attorney

We're grateful to all the sellers who shared their questions and experiences. Take a look at the comments below for a recap of Kenneth's replies and and more information.

Please note that Kenneth Kelly is not an employee or consultant of Square. The information he provides solely reflects his views and is not endorsed by Square. This Q&A is limited in scope and is only intended as a high-level overview of the topics discussed. Block, Inc. (including its affiliates, subsidiaries, employees, officers, directors, attorneys, and tax advisors) undertakes no obligation to fact check or update the information Kenneth provides for future changes in the law. Nothing in this Q&A is or should be used as tax or legal advice. In particular, this Q&A cannot be relied upon for the purposes of avoiding taxes, penalties, or other obligations under applicable law. For guidance or advice specific to your business, you should consult with a qualified tax and/or legal professional.

- Labels:

-

Business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I agree with you. This is a very deep subject that no one person can master independently. My approach to writing the book and developing the technical platform is to “democratize” this program in such a manner that we lower the cost and to educate the community on this subject. Of course I would recommend my book (www.beforeiletgo.com) as a relatable source of stories that each of us can learn. The technology platform allows you to organize our affairs in all 50 states to carry out your wishes or to organize your affairs to share with your attorney or other counselors to help you be prepared.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I'm 100% new to any sort of planning, especially estate planning. I just had my second child 6 weeks ago, and our first will be 2 on Saturday. Right now, my husband and I don't have any plan in place if something were to happen to us. I want to make sure our families don't have to stress about that and that our kids are set up financially as best we can. Where should we start, as in, what is most important and should be done this year?

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I feel like I'm in the same boat. Where do we start? I put a very basic will together when I had my daughter but so much has changed since then. I'd hate to leave a mess behind. And, what happens to my business...

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

As your questions indicate, these issues become complicated quickly. My advice to you is that you must start with the simple tasks. You can begin with ensuring that the basics are taking care of first. For instance, you need to ensure that you have an updated “will”, a living will (healthcare directive), and a power of attorney executed. Most of us do not want to leave a mess behind; however, it happened by default because we do not like dealing with the tough questions.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

This is the perfect question and I'm in the same boat however with four kids. Cant wait to hear the answer!

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Ans: from two original questions above:

1. Let’s approach this from a very basic perspective of what you care about the most. It is my assumption that your kids are the most important to you. If that is the case, the questions you must consider is if I cannot return home today and/or my spouse cannot return to pick them up today, what happens to them physically and financially. The first from my perspective is who do you want to have physical custody of the kids. This can be someone in the family or a dear friend(s) who is most likely to raise your kids in a manner that is consistent with how you would raise them. Secondly, you must consider what would it take for them to be taken care of financially. The financial needs should include what does it take to help them get to independence if you are absent. This may be the premise for having an insurance policy. Because your kids are minors, you must consider how the funds you may have set aside is there for them over the long term. As you can see, all of this takes some reasonable and considerable thinking to ensure that your kids well being is considered physically or financially.

2. As your questions indicate, these issues become complicated quickly. My advice to you is that you must start with the simple tasks. You can begin with ensuring that the basics are taking care of first. For instance, you need to ensure that you have an updated “will”, a living will (healthcare directive), and a power of attorney executed. Most of us do not want to leave a mess behind; however, it happened by default because we do not like dealing with the tough questions.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Let’s approach this from a very basic perspective of what you care about the most. It is my assumption that your kids are the most important to you. If that is the case, the questions you must consider is if I cannot return home today and/or my spouse cannot return to pick them up today, what happens to them physically and financially. The first from my perspective is who do you want to have physical custody of the kids. This can be someone in the family or a dear friend(s) who is most likely to raise your kids in a manner that is consistent with how you would raise them. Secondly, you must consider what would it take for them to be taken care of financially. The financial needs should include what does it take to help them get to independence if you are absent. This may be the premise for having an insurance policy. Because your kids are minors, you must consider how the funds you may have set aside is there for them over the long term. As you can see, all of this takes some reasonable and considerable thinking to ensure that your kids well being is considered physically or financially.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Thank you so much for your reply! Definitely going to be chatting with my husband about all of this! Looking forward to hearing the other questions and answers. 🙂

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Things I think most of us don't think about early enough/young enough! Always better to be prepared!

The Violet Fox Bookshop

https://thevioletfoxbookshop.square.site

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

You are exactly right. We are never too young to discuss these issues. My children are 18 year of age, which means they are legal adults. As so, I may not have the ability to make decision on their behalf because I am their parent and they still live within my household.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

What was your original comment? Was it deleted?

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Planning is always a good thing

Mountain Vapors

www.mountainvapors.com

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I agree with you. Unfortunately, this is not the easiest thing to do. The fact that CNBC wrote last month that it is a “State of Emergency” in the black community where the “Will” rate is only 30%. This issue still impacts all American because the rate impacts our ability to pass our possession to our loved ones.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Definitely need to get as much info about this as possible. How do we get started with planning? Is it costly?

Owner of Jackie's Uniquely U Boutique

Owner of Uniquely U Anime

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I agree with you. This is a very deep subject that no one person can master independently. My approach to writing the book and developing the technical platform is to “democratize” this program in such a manner that we lower the cost and to educate the community on this subject. Of course I would recommend my book (www.beforeiletgo.com) as a relatable source of stories that each of us can learn. The technology platform allows you to organize our affairs in all 50 states to carry out your wishes or to organize your affairs to share with your attorney or other counselors to help you be prepared.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

How can I leave my business to someone not in my family to reduce their tax liability etc? Is a trust the best solution for that?

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

You may need to speak directly with a tax accountant and/or attorney regarding the legal advice on how to leave your business to someone not in your family. My general advise on this is to consider how a transfer can begin as you are living to that there is a good understanding on your wishes. You are thinking about the right tools (trust) that can be used to accomplish your goals.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

My family has been discussing this very topic lately. Here are a few of my questions.

1. What is the differences/disadvantages/advantages in an irrevocable trust vs a revocable trust?

2. What moves should I make now to keep my estate out of probate after my death?

3. What type of life insurance policy should I have to fund my business after my death?

4. What do I need to prepare now to leave my business in someone's hands after my death?

Looking forward to hearing the answers. Thank you.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

1. There are some basic principles that must be understood. For example an irrevocable trust is one that allow you to make a decision that is technically final and hard to unwind. The revocable and irrevocable trusts can be expensive to draw up, complex to undo, in the case of an irrevocable trust, and costly to rewrite. The case of a revocable trust can allow for changes but may now give you added tax protection like an irrevocable trust. It is very difficult to dissolve an irrevocable trust, and a revocable trust doesn't necessarily protect your assets from creditors. (Depending on the state you reside in, you need to consult with advisors on the particulars in all 50 states.

2. One method of doing this is utilizing a form of trust. Also, there are methods to allow of joint ownership of certain properties (ie. Right of joint ownership with survivorship.

3. You should consider a policy that could provide the liquidity needed for the business to survive and thrive. In technical terms, this could be a size-able amount of cash or enough cash to execute liquidation.

4. Again, this depends on what state you in to determine the particular. However, I think you should begin sharing this information sooner that’s latter.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

This is all very new to me...but definitely very interesting (and something that I need to have a better understanding in). I have a few questions:

- How do set up a living trust that can help fund your future businesses?

- Where is the best place to start?

- What books do I need to help me understand (in plain terms lol) in setting up a living trust, estate planning etc.

can’t wait for you to come back with fantastic answers:)

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

1. The following is an example of setting up a trust in the State of Georgia; You will have to abide by the requires of your specific state: The Georgia revocable living trust is a legal document that holds a person’s assets and does not need to go through probate after the creator dies. The person creating the document, called the Grantor, appoints a Trustee. The Grantor may choose to appoint themselves this position, otherwise they will appoint a person they know to be trustworthy. This person is in charge of maintaining the Trust and will distribute the contents of the Trust to the Beneficiaries once the Grantor dies. Skipping probate in the State of Georgia will allow for a quicker and less expensive process for the Beneficiaries. Although a revocable living trust does not protect one’s assets from estate taxes, it will allow for the Trustee to continue to manage the Trust instead of a conservator if the Grantor becomes mentally incapacitated. All revocable trusts become irrevocable upon the Grantor’s death.

2. We designed our platform to make this process simple to create a Will, Healthcare directive and Power of Attorney. A trust can be created with our platform at an affordable price too but we do not have that feature open to the public at this time. You can contact me directly to get the ability to utilize our platform to create this feature.

3. I don’t have a specific book that you can focus on living trust. There are many out there that I am sure will cover your basic needs. Our book is at www.beforeiletgo.com