- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello Seller Community,

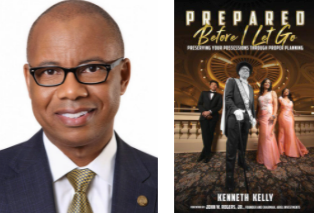

On Tuesday, March 22, we were honored to have guest author, Chairman, and CEO of First Independence Bank, Kenneth Kelly, join our forums. His work focuses on economic equality and he has extensive experience with community banking, minority depository institutions, and working minority business owners.

Kenneth recently authored a book that covers legacy planning – Prepared Before I Go: Preserving Your Possessions Through Proper Planning – which provides his views on how to create a strategy for after we're gone. His book addresses how to keep your hard-earned savings and belongings in the family, and intentionally pass on values and beliefs that are the most important part of your personal legacy.

We know many businesses represented in the Seller Community are family-owned, and wanted to create the space for you to ask our guest author questions about planning ahead, particularly in these areas:

- Will & Trust

- Healthcare Directives

- Power of Attorney

We're grateful to all the sellers who shared their questions and experiences. Take a look at the comments below for a recap of Kenneth's replies and and more information.

Please note that Kenneth Kelly is not an employee or consultant of Square. The information he provides solely reflects his views and is not endorsed by Square. This Q&A is limited in scope and is only intended as a high-level overview of the topics discussed. Block, Inc. (including its affiliates, subsidiaries, employees, officers, directors, attorneys, and tax advisors) undertakes no obligation to fact check or update the information Kenneth provides for future changes in the law. Nothing in this Q&A is or should be used as tax or legal advice. In particular, this Q&A cannot be relied upon for the purposes of avoiding taxes, penalties, or other obligations under applicable law. For guidance or advice specific to your business, you should consult with a qualified tax and/or legal professional.

- Labels:

-

Business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I agree with you. This is a very deep subject that no one person can master independently. My approach to writing the book and developing the technical platform is to “democratize” this program in such a manner that we lower the cost and to educate the community on this subject. Of course I would recommend my book (www.beforeiletgo.com) as a relatable source of stories that each of us can learn. The technology platform allows you to organize our affairs in all 50 states to carry out your wishes or to organize your affairs to share with your attorney or other counselors to help you be prepared.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

This is some really helpful information!!

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Do we need to use a lawyer to initiate a trust or even just a will, Adv Healthcare Directive or Power of Attorney? Or can we follow a template from another trust (say our parents).

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

You do not have to have an attorney although it is best. The whole reason that we created a book and technology platform to address this area was to create a low-cost method and simplified language for everyday American to understand these issues and be positioned to utilized them for their families. Our book and platform can be seen on www.beforeiletgo.comand www.MyLegacyItems.com. If you are in need for a trust I can help you get a formatted version set up also if you reach out to me on ken@beforeiletgo.com. It should be noted that the plan we have can always be shared with an attorney to ensure that you personal needs are met and that you are compliant legally in your state of residency.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I would like to know if you recommend doing any of the planning ourselves versus hiring an attorney/tax accountant..

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

A complete plan has to have several professional to maximize what you are trying to accomplish. For instance, if you are trying to create sustainable income for several generations, you need to know the consequences of how your assets are titled can impact the ability for it to assist your kids and grandkids and great grandkids. The assets being in your personal name have a different impact that being in the name of a Trust or another instruments. The best advice that I can give you is to take the time to think about what you want to accomplish. After that decision is made, you will need to bring in the experts to help you achieve that goal, which may be an attorney and a tax accountant, etc.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

How do I provide real estate for each of my children so they have a roof over their head. However, one of them I need to regulate the money so it lasts, but I want to make sure they cannot sell the properties or add anyone else's name to the property. They can leave to their children, but only if biologically theirs. Also, if they have no children then I would want that they have the option at 40 years old to sell the property if they need money for medical, bills, etc... They will always be able to pull equity out of the home. I want to leave money so the property taxes are paid automatically every year for each property. There is no mortgage.

How do I set this up - in a trust with how it is to be managed or funds released?

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

You commented that you want a Will & Trust that will allow your children to leave the property in their biological children's name (your grandchildren). May I ask, why they can only leave it to their biological children and not their adopted children?

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Your comment is a very interested questions as an observer to the original question. It questions why would anyone who adopts a child treat them any differently from a biological child. As you can imagine, this is likely a taboo subject that many could have a varying opinions. However, one’s family situation could be dynamic that this may be unnatural for the typical family. Part of this discussion is to share ideas and values on these topics so that we can all learn and make the best decisions possible for our families.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I would like to commend you for the level of thinking that you have put into this. The fact that you asked this question in the manner that you have tells me that you have assessed the situation and you recognize the realities of the skills and behaviors involved. This is often very difficult - to deal with things as they are! My suggestion is to follow up on developing a trust to manage the affairs as you have them laid. The critical part is that you will have to set up a trustee that can be trusted to handle this as you wish. In some cases that means having a non-family member to manage it to the letter of your desires. While this will feel like tough love, there is an example in my book of what can happen when you are not descriptive that will tear your heart apart to see how someone would treat their own flesh when money is involved. In the case in the book, it was a grand daughter who was left in the “cold” because the grandfather nor mother left specific plans to protect the grand daughter financially.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

what is a low cost legacy planning option? are the useful online options?

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

A low cost legacy planning option is an online option. It may not fit your needs perfectly, but it cold be the best way to organize your affairs before speaking with a professional, which can lower your cost to acquire their services because time is not wasted gathering things and putting them in order.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I'm not even sure where to begin. with planning. Maybe a bit of story might be enough for me to start on this path of mine. can't wait to listen to it. I am a student at the University of Utah.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Thanks for checking in @Pbenda! I agree, there's a lot to consider. I also wanted to make sure to clarify — this Q&A is all text-based within this post, there isn't a video/recording.

If you have any questions, be sure to reply in this thread with them. Otherwise, keep watch for Kenneth's replies to other folks' questions after March 22nd and I hope that'll help get you started with taking next steps. 💯

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

You have already demonstrated the maturity to deal with this subject just by your questions. It is never too early to start talking about this subject. In fact, I have two adult kids (ages 20 and 18) that I have started these conversations. The approach is different because of the stage of life. For instance, they are in need of Living Wills (healthcare directives) more so that just a Will. My example here is that as legal adults, I know longer have the right as a parent to dictate my wishes for them. The example is: if either of them is incapacitated and cannot speak for themselves in a medical situation like a coma, etc. As a parent, if a healthcare directive has not been signed and notarized, the decision may not be mind depending on the state requirement where we are. While this may not appear to be a big issue, it can have financial and emotional impact beyond anything any parent would want to encounter. To your question about stories, I have many stories in my book because I think it is the best way to relate the information from a positive or less than ideal situation.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I'm 63 with no family and few close friends. I don't want to burden any of my friends with my "estate" after my death. Do estate lawyers handle selling property and distribution of money in bank accounts? Is there anything I should know?

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

There are attorneys that will handle your affairs as you desire. My suggestion also is for you to consider having your assets donated to a charity of your choice (church, college for endowment of a scholarship, etc.). Many of these types of institutions will accept your legacy pledge and have an attorney take care of the handling of those affair as part of the donation process. This could be a great way to ensure that you legacy and its impact will perpetually be a benefit for others for many years to come.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Thank you . Much appreciated!

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello, I would like to know your thoughts on Trust. Is it possible to prepare a trust yourself online and have it notarized for authenticity . Trust are very expensive to have an Attorney to prepare. Mine would not be extensive, but I wanted respected.

My adult kids don’t treat me well at all and I am ill, they claim they don’t want anything for me, yet, One of them had the nerve to say, when I die, they were coming to live right here in my home. I am afraid they my get jealous of who I leave it to, and cause issues, they are jealous of each other and turn each other against me.

I am in the process of putting things in writing now. I will leave letters for them and have my signature notarized indicating I am in sound mind, which I definitely am. Please help.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Yes, there is a way to set up a trust that is not as expensive as going to counsel/attorney. You can reach me on ken@beforeiletgo.com to start this process.

- All family dynamics are different. Based on what you shared with me, my suggestion is to take care of ensuring your wishing are planned out to be executed as you desire. As you already recognize, the dynamics may be challenging, which means you should have more motivation to having your desires put in writing and executed according to your plans in a manner that is unmistakable. I wish you the very best in your planning to align with our company values: Peace, Love, and Legacy.

- As listed above, you appear to have assessed your situation. Therefore, it is vital to ensure that your wishes be declared and properly certified (notarized) in a manner that is consistent with you desires. There are a few different approaches that I write about in dealing with intense family dynamics; regardless, I wish you Peace through this process.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I’m single and have no kids, but I really want to set up a trust for my family.

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I would suggest asking a few questions to help you consider the long term outcome for your family. Is the trust to be for a specific number of individuals by name or is it to hold specific assets that can be used by family members at a later point in time. For instance are you creating a family property (farm) for every one to enjoy or are you wanting to create endowments for all kids to attend college with their tuition being paid or are you just leaving them a pile of cash that you want to protect the corpus. These are just some examples that you will need to think about to determine how to leverage a trust to be most beneficial to your family. My suggestion is for you to think about how can you leverage your asset(s) for the benefit of the family members you are considering supporting.